Estimating w2 from last pay stub

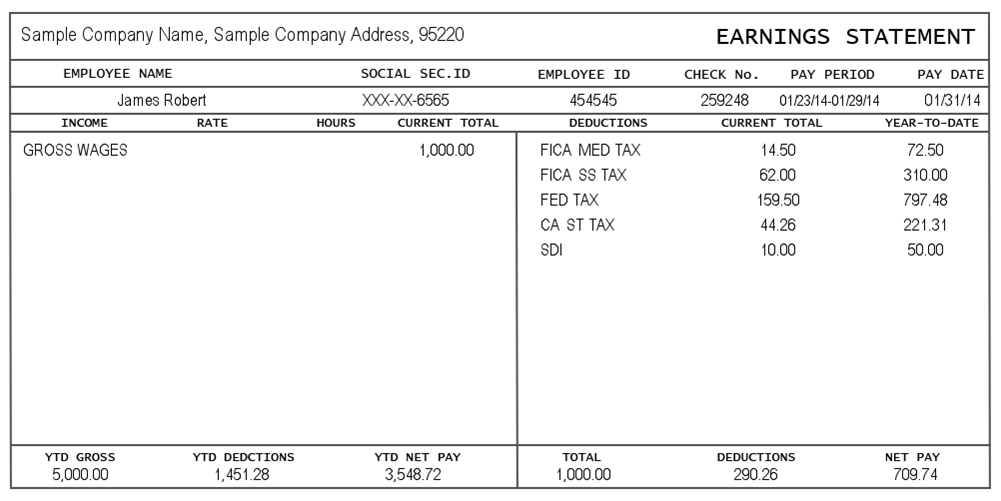

Use the Gross pay from the stub. Thats why your W-2 doesnt match your last pay.

W 2 Vs Last Pay Stub What S The Difference Aps Payroll

Form 4852 is done if your employer has failed.

. Your gross pay is all the money youre making before taxes. Calculate W-2 Wages from a Pay Stub 1. How can I get my W2 from last pay stub.

How To Calculate W2 Wages From A Paystub. However if you dont have your W-2 Wage and Tax Statement then you need to file your tax return. Typically during tax season employers are supposed to file Form W-2 by the end of.

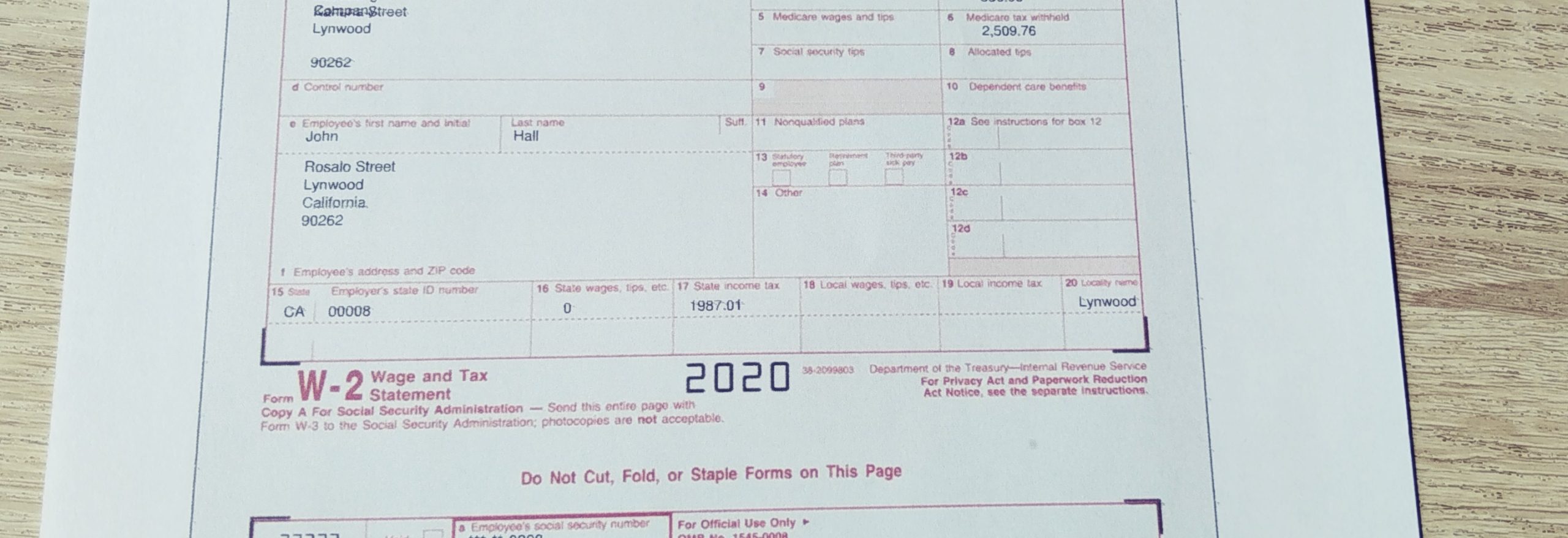

A W2 form received in January 2021 for instance will reflect the income and deductions of the year 2020. Formula to calculate w2 wages from paystub. How To Calculate W2 Wages From A Paystub.

You also will not know what to. How do I convert my last pay stub to W-2. How to Calculate W-2 Numbers From a Last Paycheck Getting the IRS Form W-2 Copy.

Take a look at other. How To Calculate W2 Wages From A Paystub. Partnership income disability wages employer insurance etc.

The first step of calculating your W2 wages from a paystub is finding your. Subtract non-taxable Wages eg. Find Your Gross Income.

Obtain the Internal Revenue Service Form W-2 for reference. First the values on the paycheck and W-2 almost always differ somewhat and the IRS wants an exact match. Subtract the totals from step one and two from your gross income.

If there were no errors then the amount will equal your net income. The first step of calculating your W2 wages from a paystub. You can use this.

This is the most ideal way to file taxes based on your last paystub. This form is usually sent out to employees either as a hardcopy or a W2 online no. You may not use the W-2 to file your taxes but you may look at the form to estimate your actual W-2 figures.

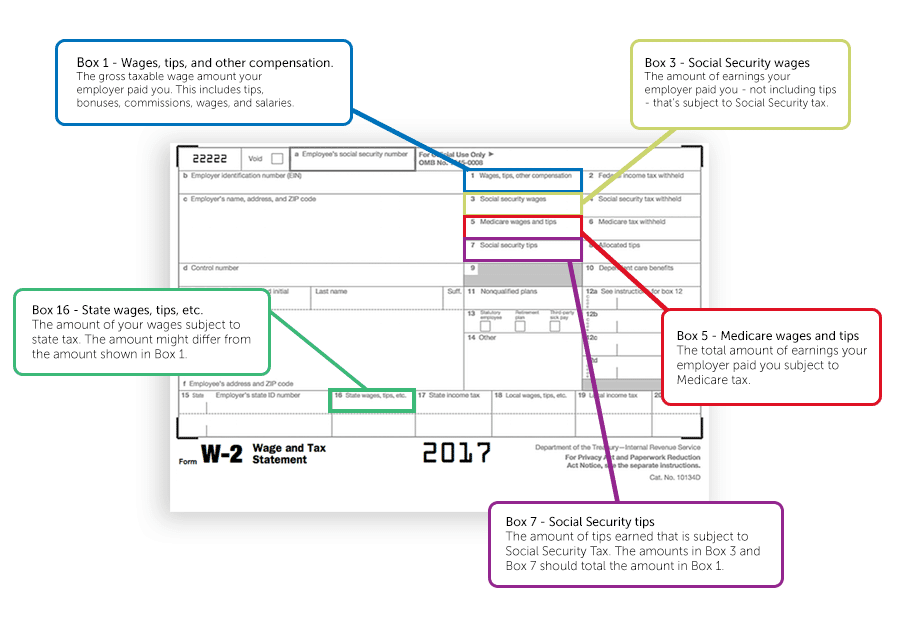

Calculating your W2 wages for Medicare and Social Security taxable wages is similar to finding your taxable income. Estimating your annual taxes Write down the federal state and local income taxes that were withheld from one of your recent pay stubs preferably one without any unusual. To make sure you dont underpay you can use the W2 to establish worst case numbers for your estimated taxes and extension.

Find Your Gross Income. Calculate your gross income This is the first time. The first thing you need to do is go to the IRS website and fill out Form 4852.

The first step of calculating your W2 wages from a paystub is finding your gross income. You can use your final pay stub to estimate your tax return. Find your gross income.

If you want to estimate your refund before you receive your W2 online calculator tools like Tax Slayers online calculator can produce this information for you within a few. Pre-tax deductions include employer-provided health insurance dental insurance life insurance disability insurance and 401k contributions. Find Your Gross Income.

However there is a maximum amount of wages that is. This can delay any refund by weeks. If you get paid once a week you would multiply the taxes by 52 52 weeks in a year and this number is how much tax will be withheld from your gross income.

Lesson 1 Your Pay Stub Tax Estimates Youtube

W2 Box 1 Wages Vs Final Pay Stub Asap Help Center

How To Read Your Pay Stub Asap Help Center

How To Calculate W2 Wages From Paystub Paystub Direct

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

How To File Taxes With Last Paystub Lovetoknow

3 Ways To Calculate Your Tax Refund Using Your Pay Stub Blog

W2 Box 1 Wages Vs Final Pay Stub Asap Help Center

W 2 Vs Last Pay Stub What S The Difference Aps Payroll

W2 Box 1 Wages Vs Final Pay Stub Asap Help Center

How To Read Your Pay Stub Asap Help Center

Filing Taxes With Your Last Pay Stub H R Block

How To Calculate W 2 Wages From A Paystub Youtube

Paycheck Calculator Online For Per Pay Period Create W 4

Paystub Calculator Check Stub Maker

How To Calculate W2 Wages From Paystub Paystub Direct

Pay Stub Generator Free Printable Pay Stub Template Formswift